Reducing Trust Accounting Compliance Risk

Project Brief

Professional trustees managing 10-15+ trusts must check each one individually to see what needs attention—there's no portfolio-level view. Unlike consumer apps, trust accounting has non-negotiable regulatory requirements. Every transaction must be classified as principal or income, annual accountings follow specific legal formats, and data integrity is critical due to fiduciary duty. I designed Entrusted to provide cross-trust visibility, progressive onboarding, and built-in compliance with CA Probate Code requirements.

Based on the competitive analysis, I honed in on a primary user persona, Sarah Johnson. She is a professional trustee with a solo law practice who manages 12 active irrevocable trusts with $18M+ in assets and 30+ beneficiaries. She handles complex CA Probate Code compliance requirements while running a solo practice. Here are the primary challenges Sarah encounters:

Must check each trust individually to see what needs attention

Excel templates relying on data entry are error prone and take 2+ hours per trust

Calendar reminders and sticky notes create constant anxiety about missed accountings

Reformatting data to meet CA Probate Code §16063 requirements takes additional time out of her day

Unlike consumer apps, I had to design within non-negotiable regulatory requirements:

- CA Probate Code §16063 requires annual accountings with specific legal formats (Schedules A-M)

- Every transaction must be classified as principal or income (legal requirement, not preference)

- Trustees have fiduciary duty and are personally liable for errors

- Accounting reports must match legal standards judges and beneficiaries expect

Competitive Analysis

I reviewed Estateably's platform to understand their navigation structure, feature set, and onboarding flow. Their strengths include statement import and §16063 report generation, but they lack portfolio-level visibility—trustees must check each trust individually. I also analyzed fintech onboarding flows (Monarch, Quicken, Origin) to identify familiar patterns. These tools prove that progressive disclosure works: users complete setup in 10-15 minutes when required fields are separated from optional steps.

Show cross-trust visibility first, drill down second

Start simple, add complexity as needed

Build regulatory requirements into the system

Every trust is unique—don't force global defaults

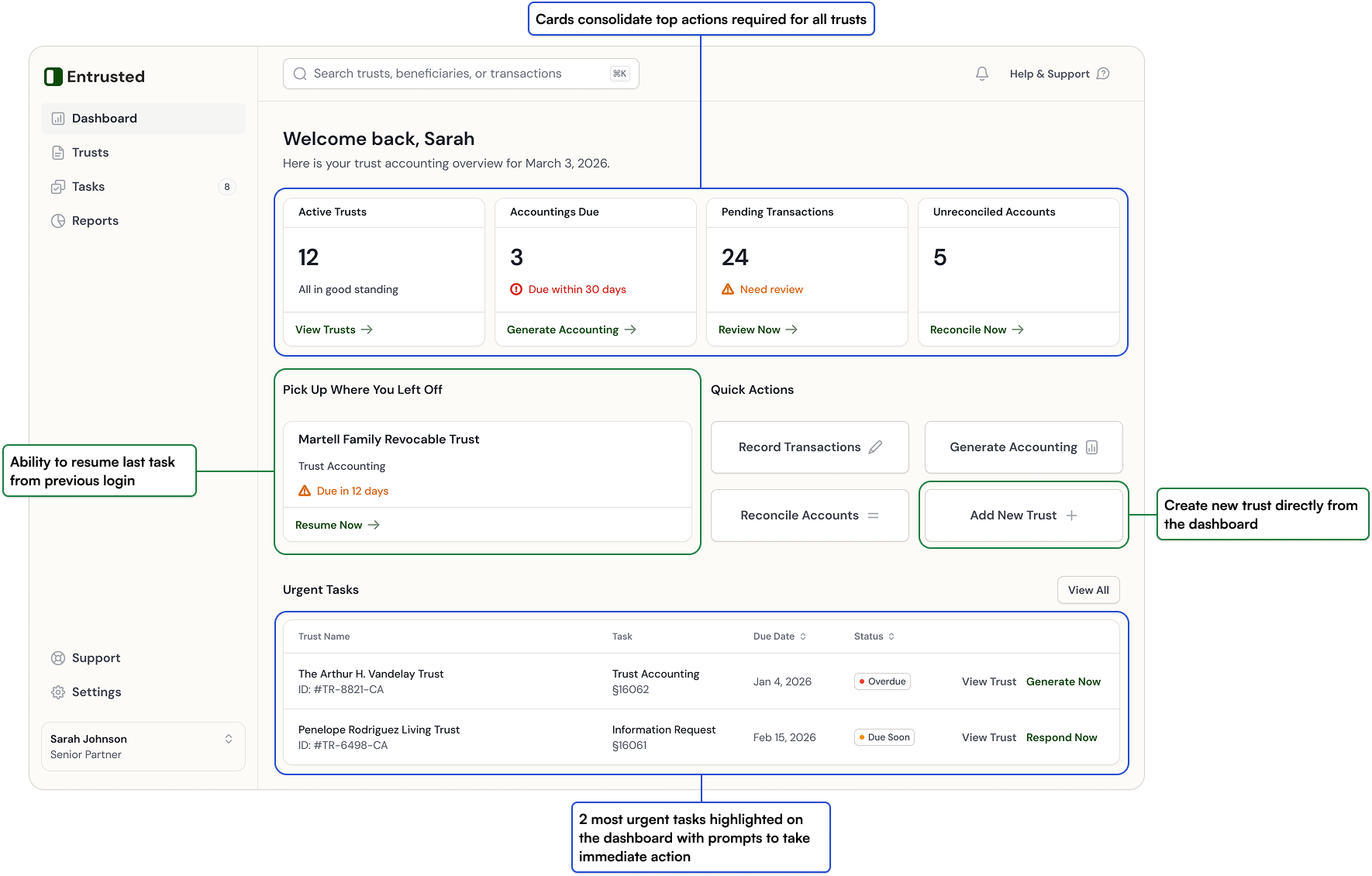

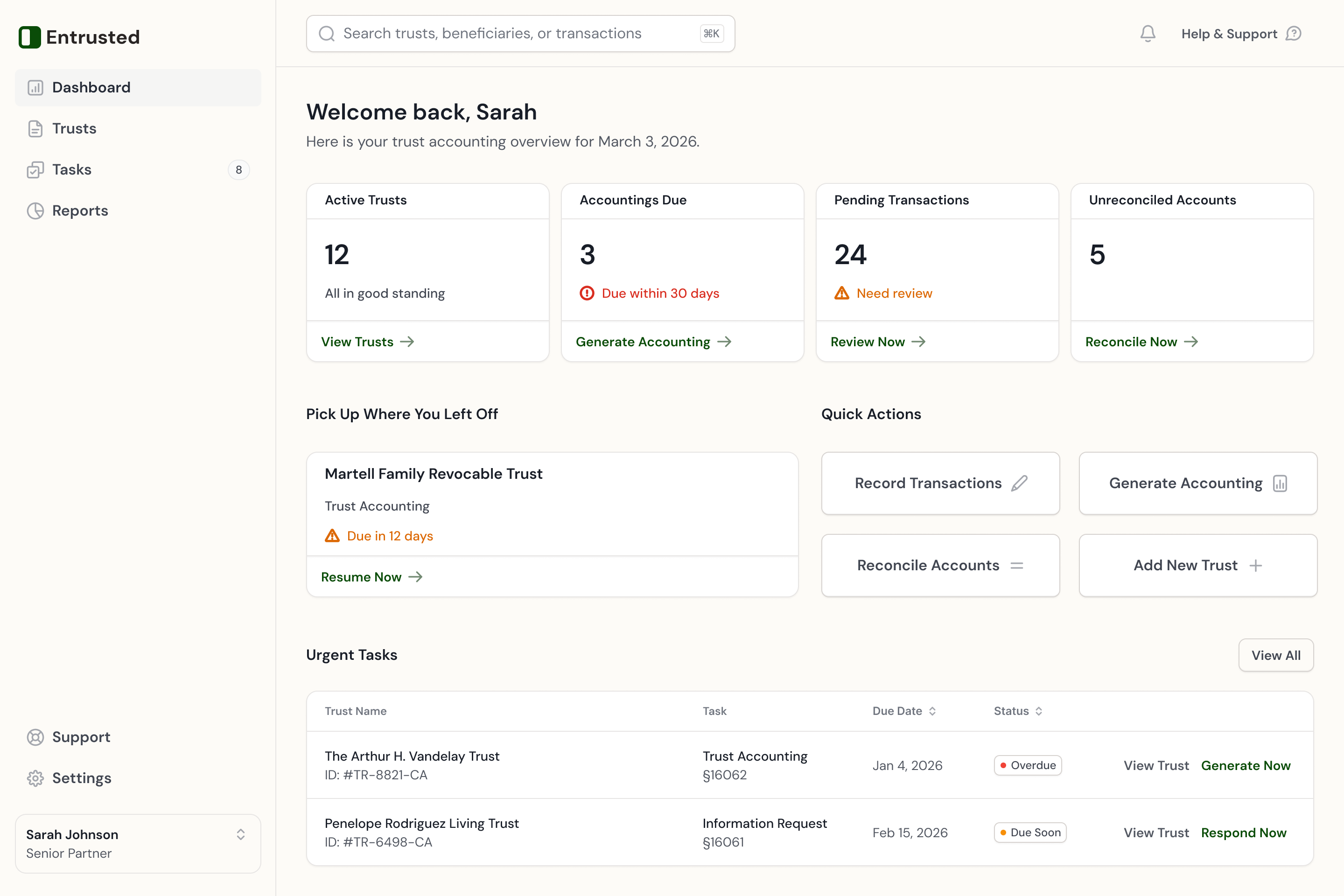

Cross-Trust Dashboard

The first thing Sarah sees when she logs in—everything that needs attention across all 12 trusts in one view.

I organized information by urgency rather than by trust because Sarah's primary workflow is triaging tasks, not browsing trusts. Card-based layout makes alerts scannable, and high-priority tasks are shown in a table for quick action.

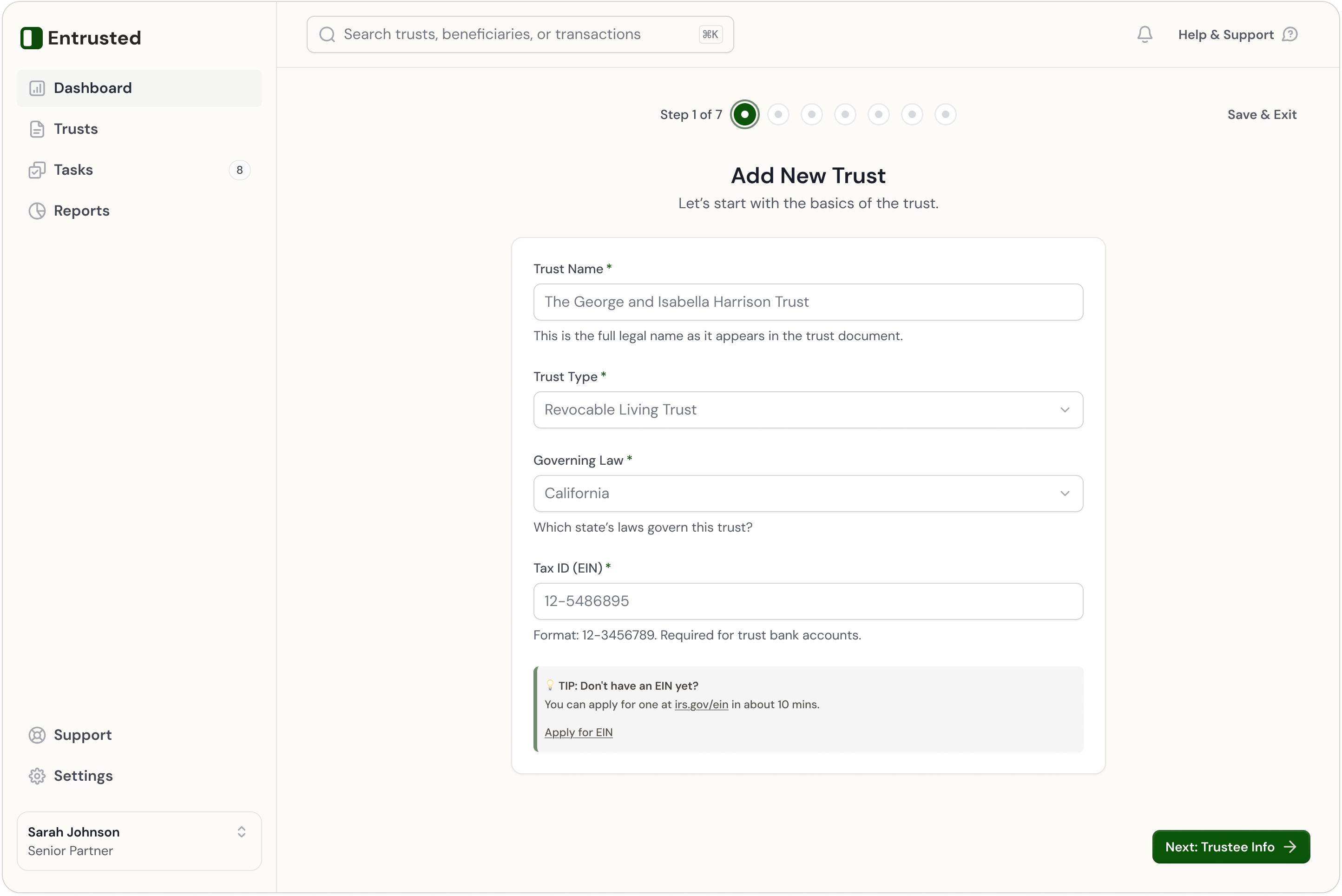

Trust Onboarding With Progressive Disclosure

I designed a 7-step onboarding flow that reduces setup from an estimated 45 minutes in Estateably to as little as 2 minutes.

- Step 1 (Required): Trust basics—name, type, EIN, governing law. Takes ~2 minutes.

- Steps 2-7 (Optional): Trustee configuration, beneficiaries, assets, bank connections can all be skipped via "Skip for Now" button

- Save & Exit: Available at any point with auto-save every 30 seconds

I analyzed the minimum data required to create a functioning trust. Trust name, type, and EIN are required by law. But assets? You can record transactions without pre-loading an asset list. Making steps 2-7 optional reduces time to value while respecting that attorneys often start work before having all information.

Minimum path: 2 minutes (Step 1 only)

Typical path: 12-15 minutes (Steps 1-3 + assets)

Complete path: 20 minutes (all 7 steps)

Goal: 75% time reduction from legacy software baseline

Inline validation on 8 critical fields (EIN: 12-3456789, SSN: 123-45-6789, dates) with tooltips explaining format requirements. Principal vs. Income toggle enforced on all transactions because misclassification has legal consequences.

Global navigation shows urgent items across all trusts. Click "Pending Transactions (24)" to see batch processing view of every transaction needing review, regardless of which trust it belongs to.

Compensation, beneficiaries, and assets configured per trust with optional profile defaults that speed up setup without forcing inflexibility. Initial design used global compensation settings, but research revealed each trust has unique legal agreements based on complexity and client relationship.

To track after launch, I would conduct usability testing with 5 attorney-trustees to measure actual time-on-task vs. projected targets and validate that progressive disclosure doesn't compromise accounting generation readiness.

Here's how I would measure success:

87% time reduction: 2+ hours → 15 minutes average setup time

Target 85%+ completion rate (vs. estimated 60% for Estateably)

Target <5% validation errors (from estimated 30% baseline)

Target 95%+ on-time accounting rate

Domain research corrected assumptions. Initially designed compensation as a global setting. Research revealed each trust has unique legal agreements. Revised to trust-specific configuration.

Progressive disclosure unlocked efficiency. Fintech apps prove 10-15 minute onboarding works when you separate required from optional. Applied this pattern: required minimum (2 min) + optional complexity (add as needed).

Horizontal visibility filled market gap. Estateably's critical weakness is siloed tasks per trust. Portfolio-level dashboard prevents "out of sight, out of mind" compliance risk.

With more time, I would conduct 10-15 user interviews with attorney-trustees, build an interactive prototype for testing, design mobile-responsive views, add bulk transaction categorization, and implement trust document OCR for auto-filling fields. After users have been onboarded, I would instrument with analytics to track behavior, A/B test messaging for optional steps, measure return rates after skipping sections, and identify accounting generation blockers.